The digital payment landscape is experiencing unprecedented transformation as consumers increasingly embrace mobile solutions over traditional payment methods. This shift represents more than just technological advancement—it's a fundamental change in how we interact with money.

The Digital Revolution

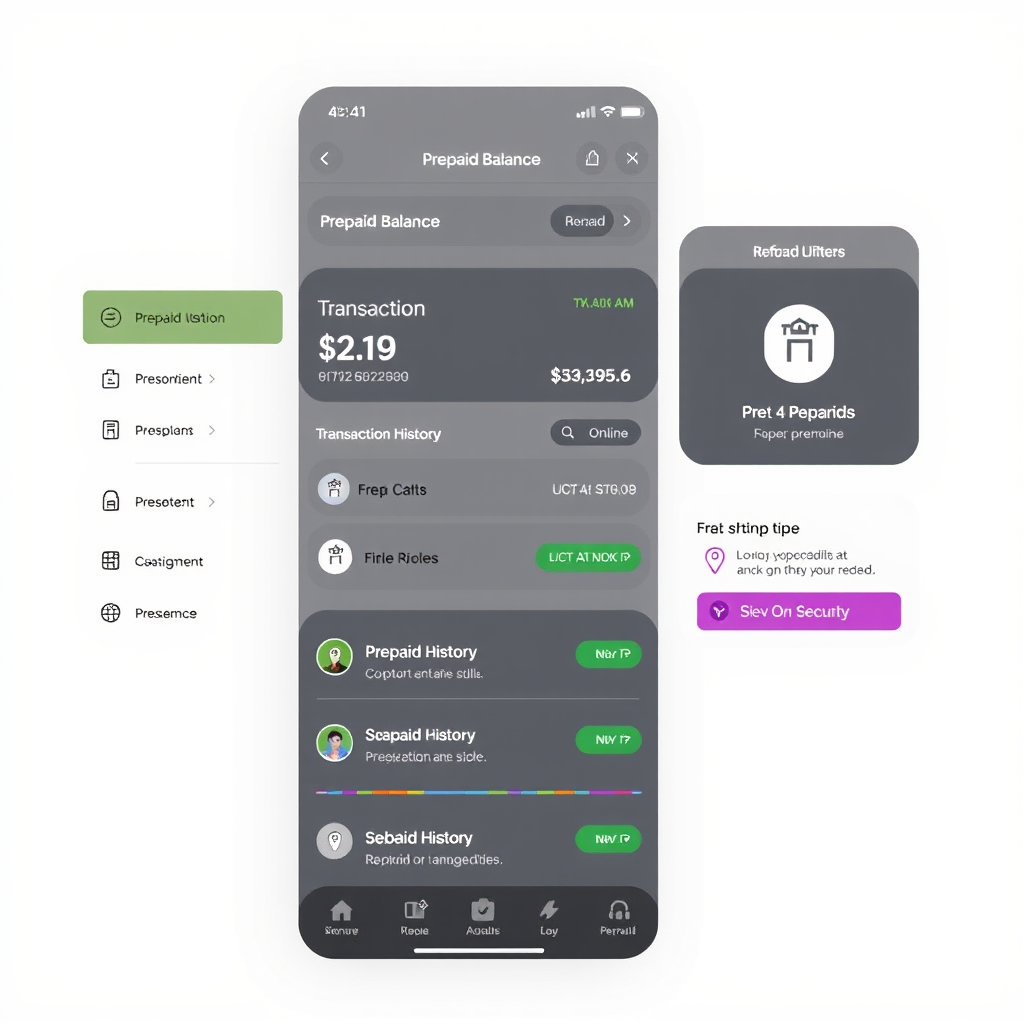

Mobile payment technologies have evolved from simple card storage apps to comprehensive financial management platforms. Today's digital wallets integrate seamlessly with prepaid services, allowing users to manage their saldo, track spending patterns, and execute transactions with unprecedented ease. The convenience factor has become the primary driver behind widespread adoption.

Recent market research indicates that over 78% of smartphone users have at least one digital application installed, with usage rates climbing steadily across all demographic groups. This trend is particularly pronounced in the prepaid sector, where users value the ability to monitor their balance and reload funds instantly.

Impact on Consumer Behavior

The integration of digital wallets with prepaid services has fundamentally altered consumer spending habits. Users now prefer the transparency and control offered by prepaid solutions, where they can easily track their saldo and avoid overspending. This shift has been particularly beneficial for budget-conscious consumers who appreciate the ability to set spending limits and receive real-time notifications.

Mobile payment platforms have also enhanced the user experience by streamlining the process of adding funds to prepaid accounts. Whether it's topping up a mobile phone plan or managing gift card balances, digital wallets have made these transactions more accessible and user-friendly than ever before.

"Digital wallets have transformed from simple payment tools into comprehensive financial companions that understand and adapt to user preferences."

Security and Trust Factors

Security remains a paramount concern in the digital payment ecosystem. Modern applications employ multi-layered security protocols, including biometric authentication, tokenization, and real-time fraud monitoring. These features have significantly increased consumer confidence in digital payment methods, particularly for prepaid transactions where users want assurance that their loaded funds are protected.

The transparency offered by digital wallets also contributes to user trust. Customers can view their transaction history, monitor their saldo in real-time, and receive notifications for any account activity. This level of visibility was previously unavailable with traditional payment methods and has become a key differentiator in the market.

Future Outlook and Innovations

The future of mobile payments looks increasingly sophisticated, with artificial intelligence and machine learning being integrated to provide personalized financial insights. These technologies will help users better manage their prepaid balances by predicting spending patterns and suggesting optimal reload amounts.

Emerging technologies such as blockchain integration and enhanced biometric security are set to further revolutionize the digital space. These innovations will provide even greater security and transparency, making digital wallets the preferred choice for managing prepaid services and maintaining financial control.

As we move forward, the convergence of mobile payments with Internet of Things (IoT) devices will create new opportunities for seamless transactions. From smart home payments to automated vehicle toll systems, digital wallets will become the invisible backbone of our connected world, making financial transactions as natural as breathing.

Key Takeaway

The rise of digital solutions represents a fundamental shift in consumer payment preferences, driven by convenience, security, and enhanced control over financial transactions. As these platforms continue to evolve, they will play an increasingly central role in how we manage our prepaid services and digital finances.